DATASET + REPORT

2H 2025 Hyperscaler Marketplace Market Sizing & Five-Year Forecast

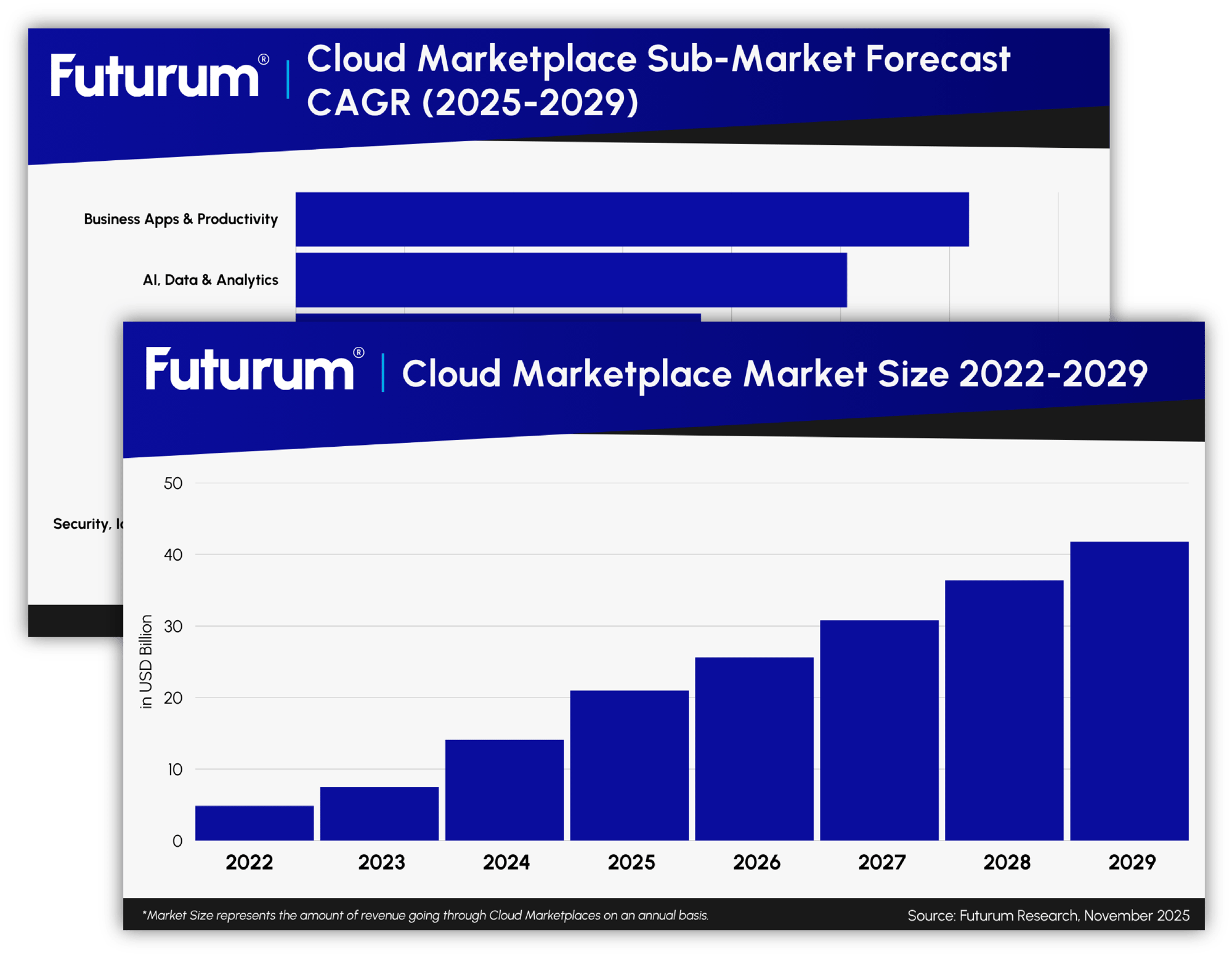

This report provides a clear, data-backed view of how hyperscaler marketplaces are rapidly becoming a core enterprise procurement channel, with spend growing from $21B in 2025 to $42B by 2029.

It highlights the fastest-growing segments — AI, data, DevOps, and regulated industries — while revealing meaningful competitive shifts among AWS, Azure, and Google Cloud.

The report distills the complex ecosystem dynamics into actionable insights for vendors, investors, and enterprise technology leaders.

Download the Free Report

VENDORS INCLUDED IN THE REPORT

AWS . Google . Microsoft . Oracle

and more

SNEAK PEEK INSIDE THE REPORT

Hyperscaler Marketplaces

-

Hyperscaler Marketplaces have become a mainstream buying channel, with over $21B in software purchases in 2025 and a path to $42B by 2029, now accounting for 5% of global enterprise software spend.

-

Procurement is shifting from infrastructure to software ecosystems, with the fastest growth coming from ISVs in AI, data, and DevOps, as enterprises increasingly buy through marketplace contracts instead of direct sales.

-

Growth varies widely by region and industry: North America is saturating while APAC and EMEA accelerate, and sectors like Healthcare, Government, and Education are poised for the strongest adoption post-2026.

-

Competition among hyperscalers is intensifying: AWS still leads, but is losing share to Azure and Google Cloud, which benefit from stronger co-sell and AI-driven catalogs, while Oracle grows in financial/ERP and Alibaba remains regionally focused.

Exclusive access to these details and more is available in the Futurum Intelligence Platform.